Out of This World Deposits

Choose your star plan and launch a rewarding deposit

Open an online deposit

Jonathan, Banks Elsewhere

"I received a NIS 30,000 loan for home renovations, without affecting my credit line at my regular bank"

Tamar, Banks Elsewhere

"I opened an online deposit account at the Bank of Jerusalem, with a better interest rate than my own bank and no commission!"

Yoel, Banks Elsewhere

"Jerusalem Brokerage's professional advice helped me make a real profit in the capital market."

Ronit, Banks Elsewhere

"After my regular bank turned me down, Bank of Jerusalem gave me a mortgage on a really special property"

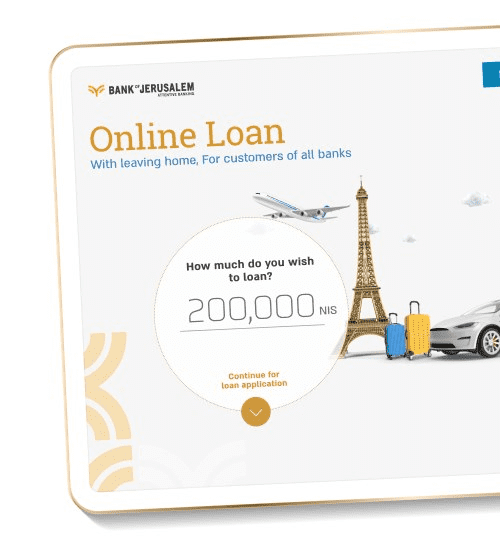

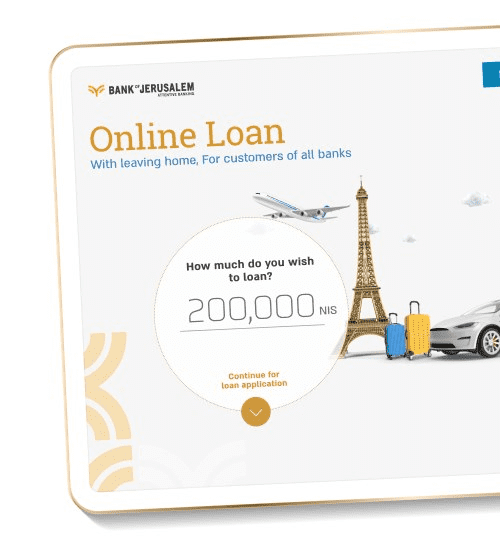

Customers of all banks can take a loan of up to NIS 200,000 without leaving home

Move forwardSmart customers, smart phones, smart banking. That's why we offer you

It's time to move forward with investment advisors and trading platforms that work for you

Move forward. Make profitA Home of Your Own?

Our mortgages come with full professional support and total peace of mind

Start making your dream a reality

Customers of all banks can take a loan of up to NIS 200,000 without leaving home

Move forward

Smart customers, smart phones, smart banking. That's why we offer you

It's time to move forward with investment advisors and trading platforms that work for you

Move forward. Make profit

A Home of Your Own?

Our mortgages come with full professional support and total peace of mind

Start making your dream a reality